It appears the Opportunity Home San Antonio (Opportunity Home) is becoming one of downtown’s chief development players.

Through two nonprofit entities it created, Opportunity Home is partnering with JMJ Development of Dallas on the St. Mary’s Tower, a 24-story apartment high-rise with a rooftop pool on the southwest corner of Villita and South St. Mary’s streets.

Opportunity Home’s involvement grants the public-private partnership a property tax exemption on the tower. In exchange, according to state law, the partnership will offer half of the 250 units to households making 80 percent of the area median income (AMI), or less; the other half will be market-rate priced. JMJ CEO Tim Barton said in an email that he’s been asked to offer some units at 60 percent AMI, presumably by Opportunity Home, but he didn’t give specifics.

Barton also said it was JMJ who approached Opportunity Home about the partnership.What’s AMI?

The area median income (AMI) for a family of four in the greater San Antonio area (Bandera, Bexar, Comal, Guadalupe and Wilson counties) is $71,000, according to the U.S. Department of Housing and Urban Development. Here’s how it breaks down for lower-income households:

» 80% – $56,800

» 70% – $49,700

» 60% – $42,600

» 50% – $35,500

» 40% – $28,400

» 30% – $21,300

Opportunity Home did not respond to an interview request for this report.

“By targeting this AMI level, the St. Mary’s Tower will be able to offer affordable housing within walking distance for an extremely large population of professional and service-oriented employees working in downtown San Antonio,” the authority said in a recent agenda.

For more info, download the San Antonio Housing Facility Corporation meeting agenda (pages 115-134) dated July 18 from Opportunity Home’s public meetings page. ]

The $62 million tower will consist of 17 stories of apartments on top of a seven-story, 290-space parking garage. The apartments will have private balconies and island kitchens.

JMJ is still proceeding with the development of a 24-story riverfront tower, consisting of 226 market-rate units, across the street, which it’s calling Villita Tower. Opportunity Home is not involved in this project, Barton said.

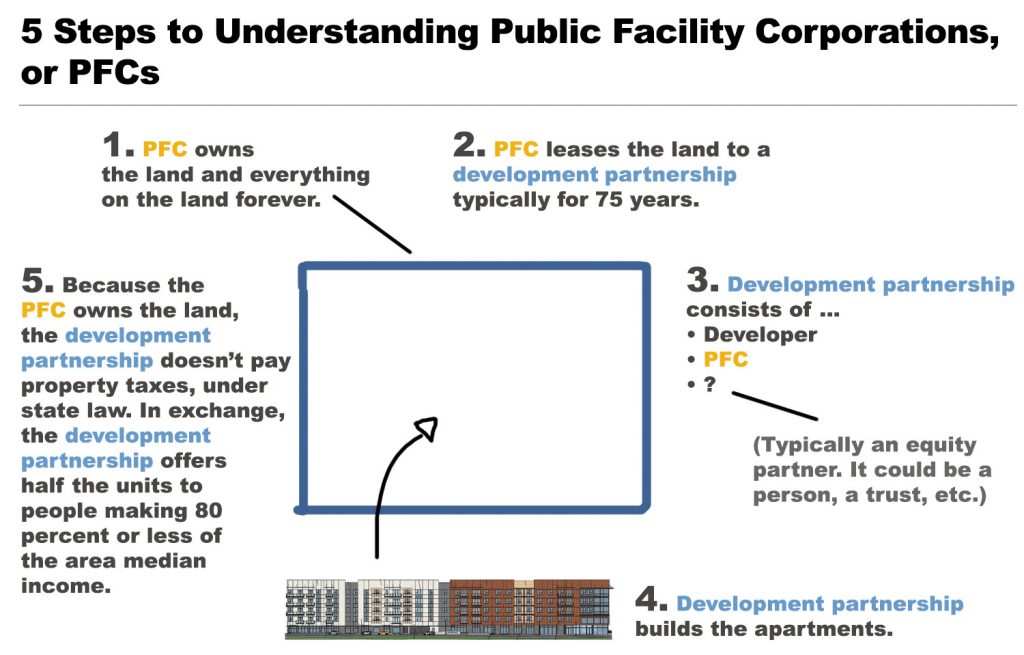

Opportunity Home will use two public facility corporations (PFCs) it controls, nonprofit entities, to purchase the land and issue tax-exempt bonds for the St. Mary’s Tower. Under state law, a development built on PFC-owned property receives a full tax exemption as long as half the units are priced at 80 percent AMI or less, which the development community characterizes as affordable housing.

Opportunity Home will also serve as the general contractor on the project, a strategy meant to eliminate sales tax on construction costs.

To fund the project, Opportunity Home-JMJ will pursue 4 percent low-income housing tax credits, tax-exempt bonds, taxable bonds, and private equity, according to the agenda. The agenda doesn’t name the private equity provider, but it does say investors can expect an 8 percent return on investment. It’s unclear if JMJ is chipping in its own equity.

According to the agenda, JMJ will procure 75 percent of cash flow from the tower; Opportunity Home would garner the other 25 percent.

The San Antonio Housing Public Corporation, one of Opportunity Home’s PFCs, would have to purchase the land at 126 Villita St., which is currently owned by CLTR Properties, according to the Bexar Appraisal District.

According to the agenda, the partnership is looking to fund the purchase the land, which is appraised at $1.6 million, as well as public infrastructure, and the construction of the parking garage through Bexar County and city incentives—which include tax increment reinvestment zone dollars. The parking garage will be made available to the public during the day, according to the agenda.

Under the city’s Center City Housing Incentive Policy (CCHIP), the St. Mary’s Tower would likely qualify for SAWS impact and city development fee waivers, as well as up to $10,000 per affordable unit (roughly 125 units) toward public infrastructure costs in the form of a grant. These incentives would apply as long as the average rent does not exceed $2.92 per square foot, which the city considers luxury.

It’s worth noting: CCHIP also provides a 75 percent rebate on city property taxes over 15 years, but Opportunity Home’s PFC involvement already grants a full property tax exemption as long as the PFC owns the property.

The Villita Tower, however, is a different story.

JMJ owns the riverfront property and would be obligated to pay its property taxes. It will qualify for the 75 percent city property tax rebate as long as the average rent is under the $2.92-per-square-foot cap. The fee waivers would kick in as well. It would only receive an infrastructure grant as long as at least 10 percent of its units were priced at 80 percent AMI or less.

In 2017, Barton told the San Antonio Express-News he expected a $70 million price tag for Villita Tower, and that rents would range between $1,500 and $3,000.

The rise of PFCs

Not too far away, on Nueva Street, Opportunity Home is joining with Austin developer Dennis McDaniel on an eight-story mid-rise called St. John’s Square.

The housing authority continues to develop across from Hemisfair and just received approval last week from the Zoning Commission on its fourth development, on Labor Street. It already owns and operates the Marie McGuire (North Alamo) and Villa Hermosa (North Flores) senior apartments.

It’s because of its ability to bring a full property tax exemption to projects, through its PFCs, that Opportunity Home is an attractive partner for private developers.

Here’s how they work:

Keep in mind, other public entities have PFCs, and have already built multifamily developments. The San Antonio Housing Trust Public Facility Corp. (city of San Antonio) and The Flats at River North (NRP Group) and The Baldwin (NRP Group), to name a few. The HemisFair Park Public Facilities Corporation (Hemisfair) and The ’68 (developer David Adelman). The ACCD Public Facilities Corporation (Alamo Colleges) and the Tobin Lofts (NRP Group).

For developers, they benefit from a full property tax exemption, which makes the project possible and more profitable.

For public entities, their participation means the creation of affordable housing.

Setting It Straight: A previous version of this article misstated the owner of the building at 126 Villita St. It’s CLTR Properties.